How to prepare your cost data

Answer the questions below to prepare your cost data. This is important in order to get started quickly.

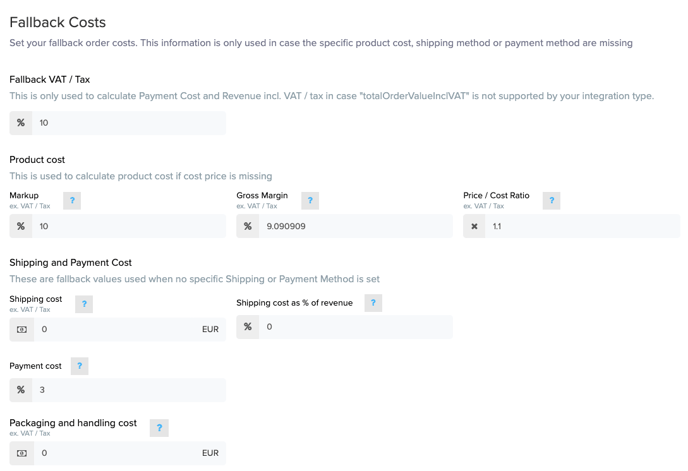

Fallback Costs

Fallback costs are configured in Expenses > Fallback Costs, and are used to provide average costs when specific costs are not available:

What is your VAT/Tax rate?

What is your average Product Markup or Margin?

Markup

Description: Markup is the amount added to the cost price of a product to determine the selling price. It is usually expressed as a percentage of the cost price.

Example: If the cost price of a product is $100 and the sales price is $300, the “Markup” is calculated as follows:

Markup Percentage=((Sales Price−Cost Price)/Cost Price)×100

Markup Percentage=((300−100)/100)×100=200%

Margin

Description: Margin is the difference between the sales price and the cost price, expressed as a percentage of the sales price. It represents the profit made on the sale.

Example: If the cost price of a product is $100 and the sales price is $300, the “Margin” is calculated as follows:

Margin Percentage=((Sales Price−Cost Price)/Sales Price)×100

Margin Percentage=((300−100)/300)×100=66.67%

Price/Cost Ratio

Description: The price/cost ratio is a simple comparison of the sales price to the cost price. It shows how many times the cost price is contained in the sales price.

Example: If the cost price of a product is $100 and the sales price is $300, the “Price/Cost Ratio” is calculated as follows:

Price/Cost Ratio=Sales Price/Cost Price

Price/Cost Ratio=300/100=3

What is your Average Shipping Cost ex. VAT/Tax?

What is your Average Payment Processing Fee (%)?

What is your Packaging and handling cost?

Exact shipping costs

Exact payment costs

Product costs